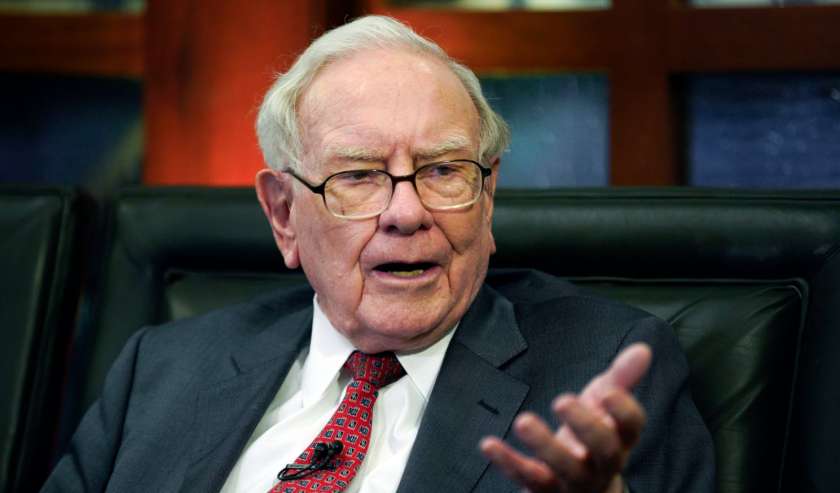

Warren Buffett reads the way most people scroll Instagram—daily, obsessively, and with astonishing focus. Long before TikTok book clubs or billionaire booklists became a trend, Buffett was already devouring hundreds of pages before breakfast. For him, reading isn’t a hobby—it’s a superpower. And every year, his recommendations offer a rare peek into the mindset of one of the greatest investors (and thinkers) of our time. From timeless investment manuals to brutally honest memoirs and witty Wall Street critiques, Buffett’s 2025 book list is a goldmine for anyone chasing insight, clarity, and long-term success.

So whether you’re a budding entrepreneur, a curious reader, or just someone trying to outthink the market—these are the 10 books Warren Buffett thinks are worth your time this year. Spoiler: #7 might just change the way you invest forever.

Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger

Category: Business Philosophy, Investing, Mental Models

What It’s About

This hefty, beloved volume is a curated collection of speeches, essays, and insights from Warren Buffett’s longtime business partner, Charles T. Munger. Part biography, part investing masterclass, part philosophy handbook, it explores Munger’s multidisciplinary approach to thinking—combining economics, psychology, history, and ethics.

Why You Should Read It

It’s more than just an investing book. Poor Charlie’s Almanack teaches you how to think—clearly, rationally, and across disciplines. If you’ve ever wanted a behind-the-scenes view into the intellectual engine of Berkshire Hathaway, this is your map. And with Munger’s signature wit and blunt wisdom, it’s also surprisingly fun to read.

Warren’s Take

Buffett’s endorsement is classic:

Get Book: Poor Charlie’s Almanack!“Just buy a copy and carry it around; it will make you look urbane and erudite,”

he joked in his 2010 shareholder letter. But behind the humor is deep admiration—Buffett has called it “a publishing miracle,” and thousands of savvy readers agree.

The Intelligent Investor by Benjamin Graham

Category: Value Investing, Financial Wisdom, Classic Finance

What It’s About

First published in 1949, The Intelligent Investor is considered the bible of value investing. Benjamin Graham—Buffett’s mentor at Columbia Business School—lays out timeless principles for making smart, disciplined financial decisions.

The book emphasizes long-term thinking, emotional control, and the concept of “Mr. Market,” a brilliant metaphor that teaches readers to treat market volatility as opportunity rather than panic.

Why You Should Read It

This isn’t just a finance book—it’s a mindset manual for anyone who wants to build wealth wisely. It strips away hype and teaches patience, humility, and logic. If you’re tired of TikTok stock advice and want the real playbook from someone who mastered the game, this is it.

Warren’s Take

Buffett has never been subtle about how much this book changed his life:

“Picking up that book was one of the luckiest moments in my life.”

He credits Chapter 8, on market fluctuations, as the moment his entire investing outlook shifted.

And in peak Buffett style, he once joked:

“Of all the investments I ever made, buying Ben’s book was the best (except for my purchase of two marriage licenses).”

If that’s not an endorsement, we don’t know what is.

A Few Lessons for Investors and Managers from Warren Buffett by Peter Bevelin

Category: Business Strategy, Investment Wisdom, Management

What It’s About

This concise, powerful book is a curated collection of Warren Buffett’s most memorable insights—pulled from decades of shareholder letters, speeches, and interviews.

Peter Bevelin distills Buffett’s philosophy on investing, leadership, decision-making, and life into digestible, quote-rich chapters.

It’s not a biography, but a beautifully organized reflection of what Buffett actually practices.

Why You Should Read It

If reading all of Berkshire Hathaway’s shareholder letters sounds daunting, this is your shortcut. It’s like carrying a highlight reel of Buffett’s best thinking—on everything from risk to reputation. Perfect for busy professionals, aspiring investors, or anyone who wants clear thinking without the fluff.

Warren’s Take

Buffett himself gave this book a nod in 2011, saying it “sums up what Charlie and I have been saying over the years in annual reports and at annual meetings.”

In other words, it’s not about reinventing Buffett—it’s about capturing Buffett, clearly and concisely.

Get Book: A Few Lessons for Investors and Managers From Warren Buffet!The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success by William N. Thorndike

Category: Business Leadership, Capital Allocation, Company Culture

What It’s About

This book spotlights eight visionary CEOs who defied Wall Street norms and delivered extraordinary long-term performance—not by flashy moves, but through disciplined capital allocation and measured decision-making. Think less hype, more math.

Each profile reveals how these leaders quietly outperformed peers by focusing on smart investments, cost control, and long-term thinking.

Why You Should Read It

If you’ve ever wondered what makes a truly great CEO—not just a charismatic one—The Outsiders lays it bare. It challenges conventional wisdom and replaces it with a blueprint of clarity, rationality, and results. A must-read for founders, board members, and business students alike.

Warren’s Take

Buffett gave this book high praise in 2012:

“It has an insightful chapter on our director, Tom Murphy—overall the best business manager I’ve ever met.”

He called the book “outstanding,” especially for its clear-eyed view of capital allocation—one of Buffett’s personal cornerstones of business success.

Get Book: The Outsiders!The Clash of the Cultures: Investment vs. Speculation by John C. Bogle

Category: Investing, Financial Ethics, Market Behavior

What It’s About

In The Clash of the Cultures, Vanguard founder John C. Bogle sounds the alarm on the shift from long-term investing to short-term speculation.

He exposes how modern financial markets have become dominated by trading, hype, and fleeting gains—eroding the true purpose of investing: owning assets that grow real value over time.

Through data and sharp commentary, Bogle lays out a roadmap to reclaim ethical, sensible investing.

Why You Should Read It

This book isn’t just for financial pros—it’s for anyone with a retirement account, a savings plan, or a curiosity about where their money goes. Bogle gives you clarity in a sea of noise. If you want to protect your portfolio and your principles, this is essential reading.

Warren’s Take

Buffett has long admired Bogle for putting investors first, and this book echoes values Buffett himself champions. While he hasn’t offered a punchline quote on this one, its presence in his reading list speaks volumes: it’s a sobering, timely reminder to focus on value, not vanity metrics.

Get Book: The Clash of the Cultures: Investment vs. Speculation!40 Chances: Finding Hope in a Hungry World by Howard G. Buffett

Category: Philanthropy, Global Development, Social Impact

What It’s About

Written by Warren Buffett’s son, Howard G. Buffett, 40 Chances explores how to make the most of the roughly 40 productive years most people have in their careers—using them to drive meaningful change.

Through vivid storytelling from Howard’s travels across conflict zones and food-insecure regions, the book highlights innovative solutions to hunger, poverty, and sustainability challenges. It’s part memoir, part manifesto, and a powerful call to action.

Why You Should Read It

This isn’t just a book about charity—it’s about using time, money, and influence wisely. Whether you’re an entrepreneur, student, or changemaker, 40 Chances offers a lens into real-world problem-solving fueled by compassion and pragmatism. It’s also a deeply personal story of a son carving his own path under the legacy of one of the world’s most influential figures.

Warren’s Take

Warren Buffett has praised 40 Chances not just as a proud father, but as someone who believes in measured, meaningful impact. The book reflects the values he instilled in his children: humility, effectiveness, and the drive to leave the world better than you found it. It’s a Buffett-approved blueprint for turning good intentions into real results.

Get Book: 40 Chances!The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns by John C. Bogle

Category: Personal Finance, Index Investing, Long-Term Wealth

What It’s About

This compact guide distills decades of financial wisdom into one clear message: Buy and hold low-cost index funds. Bogle, the father of index investing and founder of Vanguard, explains why most individual investors (and even professionals) underperform the market—and how embracing simplicity and discipline can dramatically shift the odds in your favor. No stock-picking, no market timing—just common sense.

Why You Should Read It

If you’re tired of flashy stock tips and investment “hacks,” this book is your reset button. It’s the ultimate beginner-friendly (and expert-backed) guide to investing with integrity and long-term thinking. You’ll walk away not just with strategy, but with clarity.

Warren’s Take

Warren Buffett has repeatedly recommended this book and its author:

“Rather than listen to the siren songs from investment managers, investors—large and small—should instead read Jack Bogle’s The Little Book of Common Sense Investing,” he said.

Buffett even advised his own heirs to invest the bulk of their inheritance in low-cost S&P 500 index funds—a principle straight out of Bogle’s playbook.

Get Book: The Little Book of Common Sense Investing!Where Are the Customers’ Yachts? Or a Good Hard Look at Wall Street by Fred Schwed Jr.

Category: Financial Humor, Wall Street Critique, Behavioral Finance

What It’s About

Originally published in 1940, this book remains one of the most biting critiques of the financial industry ever written. Fred Schwed Jr., a former stockbroker turned writer, skewers the absurdities of Wall Street culture with wit and honesty.

He unpacks how brokers, advisors, and institutions often prosper—while their customers are left wondering where their “yachts” are. It’s hilarious, insightful, and uncomfortably relevant, even decades later.

Why You Should Read It

This isn’t just a history lesson—it’s a reality check. If you’ve ever felt like financial advice was designed to enrich everyone but you, this book explains why. It’s perfect for investors who want to stay smart, skeptical, and in control of their financial future—with a side of dry humor.

Warren’s Take

Buffett has consistently praised this book over the years for its clarity and candor:

“This is the funniest book ever written about investing,” he once said. “It delivers the truth with a smile and a wink.”

He believes every investor should read it—not just to laugh, but to learn how to protect themselves from the industry’s oldest traps.

Get Book: Where Are the Customers’ Yachts? Or a Good Hard Look at Wall Street!Limping On Water: My Forty-Year Adventure with One of America’s Outstanding Communications Companies by Phil Beuth with K.C. Schulberg

Category: Memoir, Leadership, Media & Business Strategy

What It’s About

Phil Beuth chronicles his rise from humble beginnings to becoming a key executive at Capital Cities Communications, a media empire that later merged with ABC. This isn’t just a corporate success story—it’s a tale of perseverance, loyalty, and leading with both heart and grit.

Beuth, born with a physical disability, shares the highs and lows of a decades-long career that redefined the broadcasting landscape.

Why You Should Read It

If you’re looking for more than flashy business advice, Limping On Water offers real lessons in resilience, ethical leadership, and people-first management. It’s also a rare behind-the-scenes look at the media industry from someone who helped shape it. The story’s sincerity and humility make it stand out in a genre often filled with ego.

Warren’s Take

Buffett has personally endorsed Limping On Water, calling it “a terrific read about a terrific guy.”

The book reflects many of the values Buffett holds dear—integrity, long-term thinking, and the power of quiet determination. Beuth was part of the Capital Cities team that Buffett famously invested in and admired, making this memoir both a business lesson and a personal tribute.

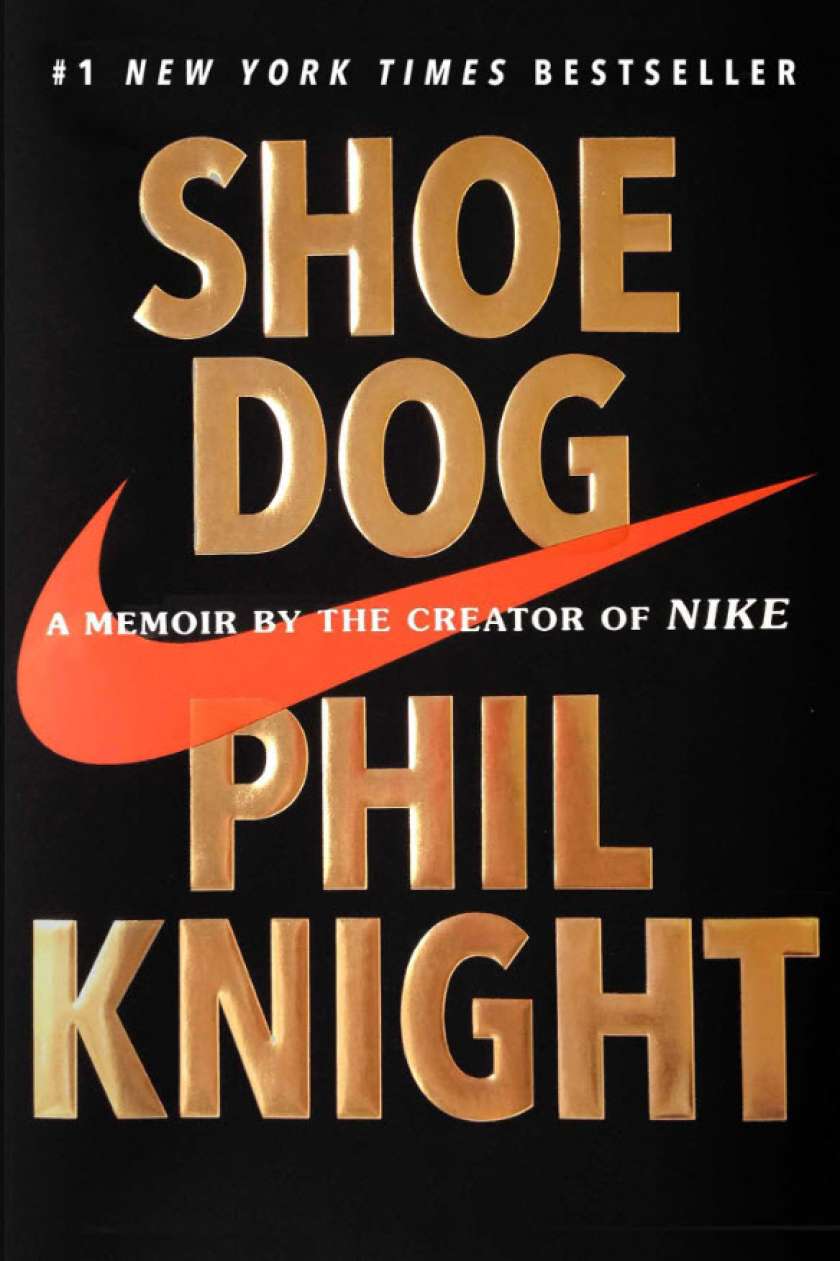

Get Book: Limping On Water!Shoe Dog by Phil Knight

Category: Memoir, Entrepreneurship, Business Strategy

What It’s About

Shoe Dog is the riveting memoir of Nike co-founder Phil Knight, chronicling the chaotic, scrappy, and visionary years of building one of the most iconic brands in the world.

Far from a polished success tale, Knight takes readers through cash flow crises, near-bankruptcies, bold gambles, and emotional struggles that defined the company’s early life.

Why You Should Read It

This isn’t a how-to guide—it’s a brutally honest portrait of what it really takes to build something meaningful. Whether you’re an aspiring entrepreneur or just love a good underdog story, Shoe Dog delivers raw insight, humor, and relentless drive. Knight doesn’t claim to have all the answers—he just shows you the journey, warts and all.

Warren’s Take

Warren Buffett has singled out Shoe Dog as “the best book I read last year” (in his 2016 Berkshire Hathaway letter).

He praised Knight’s storytelling and admired how the memoir captured the tension and truth behind building a great business. For Buffett, Shoe Dog is more than inspiration—it’s a reminder that resilience and belief often matter more than business plans.

Get Book: Shoe Dog!Lastly,

Warren Buffett’s reading list isn’t about chasing trends—it’s about mastering the fundamentals, thinking independently, and building a life (and legacy) with intention. These books aren’t flashy—they’re wise. They challenge, provoke, and quietly sharpen your thinking. Whether you’re flipping pages on investing, leadership, or life itself, each title is a brick in the foundation of Buffett’s billion-dollar mindset. So take a page—literally—from his bookshelf. Because when the Oracle of Omaha highlights a book, it’s not just a read—it’s a roadmap.